Continuing the conversation about moving away from RevPAR and towards using TrevPAR and GOPPAR in a revenue management programme, Jonathan Langston’s presentation at the AHC in Manchester last week gave some fascinating insights into how increased commission costs have been a key driver in the erosion of profitability over the past decade.

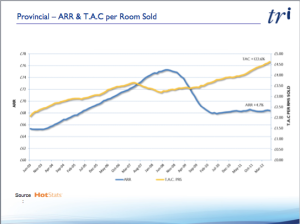

Referencing the Hotstats benchmarking programme that tracks Average Room Rate and RevPAR per total rooms sold, he demonstrated how the metrics have changed over the past 10 years in the UK provinces and London. Whilst ARR and RevPAR trend to the positive in London over the 10 years reviewed, operational costs of payroll and F&B have steadily increased, resulting in an overall decrease in profitability illustrated by the increasing gap between RevPAR and GOPPAR.

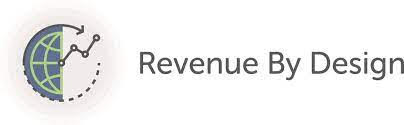

Reports show that between June 2002 and March 2012, average room rate increased by over 49% from £80 to £120 in London, whilst commission payments increased by 146% and now cost hotels over £6 for every room sold – not just those sold through agency channels.

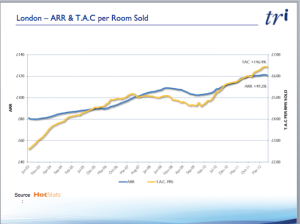

Whilst average rate has not performed as well in the Provinces, which took a huge hit throughout the recession, showing a net rise over the same period of 4.7% from just shy of £66 to around £68, commission payments to agencies over the same period have risen by 122.6% from about £2.00 per total rooms sold to just over £4.50 per total rooms sold.

Form 2009 figures show the decline in profitability in F&B and payroll, for London and the Provinces driven by increases in food costs:

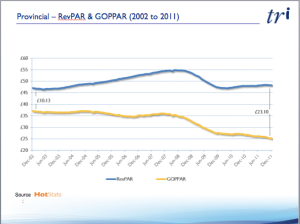

Bearing in mind these declines in profitability, when we now turn to RevPAR and GOPPAR metrics over the same period it becomes clear how RevPAR under-performs as a benchmark of overall performance compared to GOPPAR. Looking solely at RevPAR we could be led to draw more positive conclusions if we don’t take GOPPAR into consideration.

Similarly for the UK provinces GOPPAR metrics illustrate the hit on ARR over the recession, and the gap between RevPAR and GOPPAR increases by almost 130% over the period 2002 – end 2011.

Interestingly, these benchmarks won’t take into consideration cost of sale through net rate programmes where payments are deducted at source, and therefore won’t show up on a P&L. Whilst a net rate programme will drive a decrease in ADR, since the rate will be posted net of commission, the actual cost of sale will not be tracked. So the true cost of sale to hotels is likely to be much higher. Total Revenue Management programmes are key to gaining insight into true profitability and setting up benchmarks such as GOPPAR the first steps to getting a programme up and running.

See also – our F&B and Meeting and Events revenue management training courses to create a framework for a Total Revenue Management

For more information on HotStats visit the web site